Neighborhood Assistance Program (NAP)

Your donation may qualify for a tax credit in Virginia!

Limited tax credits are available until June 30.

Contributions must be pre-approved for tax credit. Contact United Community today for complete information.

What is NAP?

The Neighborhood Assistance Program (NAP) is a program administered under the Virginia Department of Education which allows individuals and businesses to receive state tax credits for supporting approved charities such as United Community.

Your gift to United Community through the NAP program will support exceptional learning experiences at two critical United Community Programs:

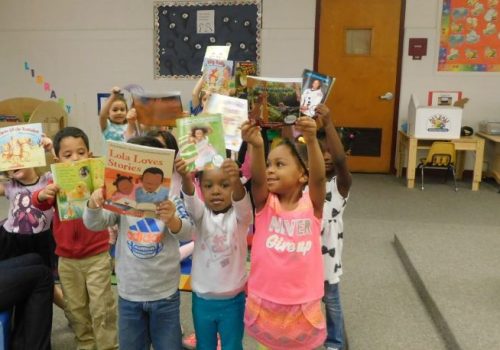

- Early Learning Center, which provides affordable, quality care to children ages 6 weeks to 5 years old.

- Progreso Center for Literacy and Citizenship, which empowers immigrants through educational programs, citizenship services, and immigration assistance services.

Through our participation in the Neighborhood Assistance Program, businesses and individuals who donate to United Community may be eligible to receive Virginia state tax credits for their gifts.

Why give to United Community through the NAP?

- United Community’s NAP donors may receive tax credits valued at 50% of their donation.

- You can use your NAP tax certificate for up to 5 years after your initial donation.

- You can give a variety of gift types, including cash donations, real estate, and marketable securities.

How do you take advantage of this program?

NAP credits are given on a first-come, first-serve basis. United Community is allocated a limited amount of tax credits for this popular program. Contact Jennifer Johnson at 703.927.2389 or jennifer.johnson@unitedcommunity.org today for complete information and reserve your tax credits.

Please Note:

Donations made through the NAP program must pre-approved by United Community in order to receive tax credits. Please contact Jennifer Johnson at 703.927.2389 or jennifer.johnson@unitedcommunity.org for complete information prior to making your gift.

All donations must be made directly to United Community with no strings attached and without any conditions or expectations of monetary or other benefits received from United Community. Previous donations are not eligible.

Information is not intended to provide, and should not be relied, on

for tax, legal, or accounting advice. Please consult your independent

tax advisor before engaging in any transactions.